How to Use a Credit Card on Cash App: A Comprehensive Guide

Cash App, the popular mobile payment service developed by Block, Inc., allows users to send and receive money, invest, and even manage their finances. While primarily known for its debit card functionality and bank account linking, many users wonder, “Can I use a credit card on Cash App?” The answer is yes, but with certain considerations. This comprehensive guide will walk you through the process, explain the associated fees, and provide tips for using your credit card responsibly on Cash App.

Understanding Cash App and Credit Card Integration

Cash App is designed for quick and easy peer-to-peer transactions. It excels at facilitating payments between friends, family, and even small businesses. While debit cards and bank accounts are the primary funding sources, Cash App does allow you to link and use a credit card on Cash App. However, it’s essential to understand the implications before you start swiping.

Why Use a Credit Card on Cash App?

There are several reasons why you might choose to use a credit card on Cash App:

- Convenience: You might not have sufficient funds in your bank account or debit card at the moment.

- Rewards: Using a credit card can earn you rewards points, cashback, or travel miles, depending on your card’s benefits.

- Emergency Situations: In urgent situations, using a credit card on Cash App can provide immediate access to funds.

Adding a Credit Card to Cash App: A Step-by-Step Guide

Adding a credit card to your Cash App account is a straightforward process:

- Open Cash App: Launch the Cash App application on your smartphone.

- Tap the Profile Icon: Locate and tap the profile icon, usually found in the upper-right corner of the screen.

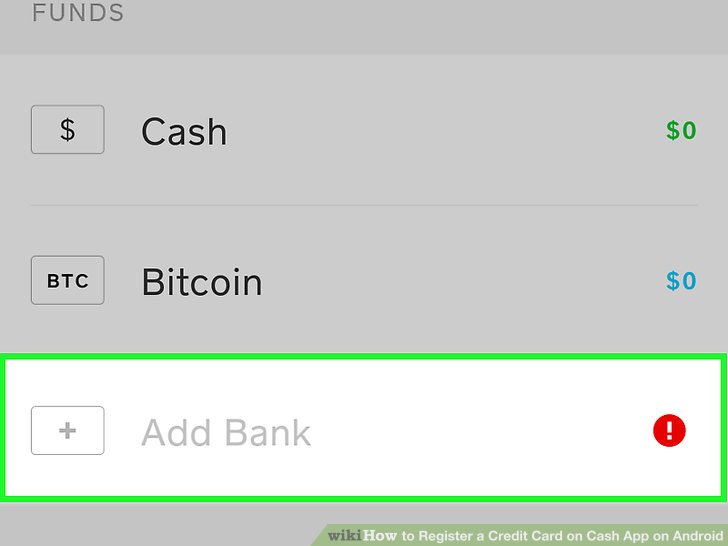

- Select “Linked Banks”: Scroll down and select the “Linked Banks” option.

- Add Bank or Card: Choose the “Add Bank or Card” option.

- Select “Add Credit Card”: Select the option to add a credit card.

- Enter Card Details: Carefully enter your credit card number, expiration date, CVV code, and billing zip code.

- Verify Information: Double-check all the information you’ve entered to ensure accuracy.

- Confirm: Tap the “Add Card” button to complete the process.

Once you’ve completed these steps, your credit card will be linked to your Cash App account and ready for use.

Fees Associated with Using a Credit Card on Cash App

Before you start using your credit card on Cash App, it’s crucial to be aware of the associated fees. Cash App charges a standard fee of 3% for transactions funded by a credit card. This fee can add up quickly, so it’s essential to factor it into your calculations.

For example, if you send $100 using your credit card, Cash App will charge a $3 fee, resulting in a total charge of $103 to your credit card.

Comparing Fees: Credit Card vs. Debit Card

It’s important to note that Cash App does not charge a fee for transactions funded by a debit card or your Cash App balance. Therefore, if you’re looking to minimize fees, using a debit card or your Cash App balance is the more cost-effective option.

How to Send Money Using a Credit Card on Cash App

Once your credit card is linked, sending money is simple:

- Open Cash App: Launch the Cash App application.

- Enter the Amount: Enter the amount of money you want to send.

- Tap “Pay”: Tap the “Pay” button.

- Enter Recipient Details: Enter the recipient’s $Cashtag, phone number, or email address.

- Add a Note (Optional): Add a note describing the purpose of the payment.

- Confirm Payment Method: Ensure that your credit card is selected as the payment method. If not, tap the payment method and select your credit card.

- Tap “Pay”: Tap the “Pay” button to send the money.

The recipient will receive the money instantly, and your credit card will be charged the amount plus the 3% fee.

Risks and Considerations When Using a Credit Card on Cash App

While using a credit card on Cash App can be convenient, it’s essential to be aware of the potential risks and considerations:

- Cash Advance Fees: Some credit card issuers may classify Cash App transactions as cash advances, which can trigger higher interest rates and additional fees. Check with your credit card issuer to understand their policies.

- Interest Charges: If you don’t pay your credit card balance in full each month, you’ll accrue interest charges on the amount you’ve spent, including the Cash App transactions.

- Overspending: The ease of using a credit card on Cash App can lead to overspending if you’re not careful. It’s essential to track your spending and budget accordingly.

- Security: While Cash App employs security measures to protect your information, it’s always wise to be cautious and avoid sending money to unknown individuals or suspicious accounts.

Alternatives to Using a Credit Card on Cash App

If you’re concerned about the fees or risks associated with using a credit card on Cash App, consider these alternatives:

- Debit Card: Using a debit card linked to your bank account is a fee-free option.

- Cash App Balance: Transfer funds from your bank account to your Cash App balance and use that to make payments.

- Other Payment Apps: Explore other payment apps like Venmo or PayPal, which may offer different fee structures or features.

- Direct Bank Transfers: If you’re sending money to someone you trust, consider a direct bank transfer, which is often free or has lower fees.

Tips for Responsible Credit Card Use on Cash App

If you decide to use a credit card on Cash App, follow these tips to ensure responsible usage:

- Track Your Spending: Monitor your Cash App transactions and credit card balance regularly to avoid overspending.

- Pay Your Balance in Full: Pay your credit card balance in full each month to avoid interest charges.

- Avoid Cash Advances: Check with your credit card issuer to ensure that Cash App transactions are not classified as cash advances.

- Be Cautious: Only send money to people you know and trust. Avoid suspicious accounts or requests.

- Consider Alternatives: Explore alternative payment methods like debit cards or your Cash App balance to minimize fees.

Security Measures on Cash App

Cash App implements several security measures to protect your financial information. These include:

- Encryption: Cash App uses encryption to protect your data during transmission.

- Fraud Detection: Cash App employs fraud detection systems to identify and prevent suspicious transactions.

- Two-Factor Authentication: You can enable two-factor authentication to add an extra layer of security to your account.

- PIN or Touch ID: You can require a PIN or Touch ID to access your Cash App account.

Despite these security measures, it’s essential to remain vigilant and protect your account information. Never share your PIN or password with anyone, and be cautious of phishing scams or suspicious emails.

Conclusion: Is Using a Credit Card on Cash App Right for You?

The decision of whether or not to use a credit card on Cash App depends on your individual circumstances and financial habits. While it offers convenience and the potential to earn rewards, it also comes with fees and potential risks. By understanding the associated costs, risks, and alternatives, you can make an informed decision that aligns with your financial goals. If you prioritize minimizing fees and avoiding debt, using a debit card or your Cash App balance is likely the better option. However, if you need immediate access to funds or want to earn credit card rewards, using a credit card on Cash App may be a viable option, provided you do so responsibly.

Remember to always track your spending, pay your balance in full, and be cautious of potential risks. By following these guidelines, you can safely and effectively use a credit card on Cash App when it makes sense for you. [See also: How to Link a Bank Account to Cash App] [See also: Cash App Investing: A Beginner’s Guide]