Can You Send Venmo to Apple Pay? Understanding the Integration and Alternatives

In today’s digital age, mobile payment platforms like Venmo and Apple Pay have become integral to our daily financial transactions. The convenience they offer is undeniable, allowing users to send and receive money with just a few taps on their smartphones. A common question that arises among users of both platforms is: Can you send Venmo to Apple Pay? This article delves into the intricacies of this integration, explores the possibilities, and provides alternative solutions for transferring funds between these popular services.

Understanding Venmo and Apple Pay

Before addressing the core question, let’s briefly outline what Venmo and Apple Pay are and how they function.

Venmo: The Social Payment App

Venmo, owned by PayPal, is a mobile payment app primarily designed for peer-to-peer (P2P) transactions. It allows users to easily send and receive money with friends, family, and acquaintances. Venmo stands out due to its social feed, where users can see (and comment on) their friends’ transactions, adding a social layer to financial interactions. However, this feature can be adjusted for privacy. Users can link their bank accounts, debit cards, or credit cards to fund their Venmo transactions. The platform also offers a Venmo debit card, providing users with a physical card to spend their Venmo balance in stores. It is a popular choice for splitting bills, paying rent, or reimbursing friends.

Apple Pay: The Digital Wallet

Apple Pay, on the other hand, is a digital wallet and mobile payment service developed by Apple Inc. It allows users to make contactless payments in stores, in apps, and on the web using their Apple devices (iPhone, iPad, Apple Watch, and Mac). Apple Pay works by storing credit and debit card information securely on the device, using tokenization to protect sensitive data. When a user makes a payment, Apple Pay transmits a unique, encrypted transaction code to the merchant, rather than the actual card details. This enhances security and reduces the risk of fraud. Apple Pay is widely accepted at merchants that support contactless payments, making it a convenient option for everyday purchases.

The Direct Integration Question: Can You Directly Send Venmo to Apple Pay?

Now, let’s tackle the primary question: Can you send Venmo to Apple Pay directly? The straightforward answer is no. As of the current date, there is no direct integration or feature that allows users to transfer funds directly from Venmo to Apple Pay or vice versa. These two platforms operate as separate entities, each with its own infrastructure and protocols. Venmo primarily focuses on P2P transactions and online payments, while Apple Pay is geared towards contactless payments at physical stores and in-app purchases.

The lack of direct integration is due to several factors, including business strategies, competitive landscape, and technical considerations. Both Venmo and Apple Pay have their own unique user bases and ecosystems, and they may not see a strategic advantage in directly integrating with each other. However, this doesn’t mean that transferring funds between the two platforms is impossible. It simply requires alternative methods and workarounds.

Alternative Methods to Transfer Funds Between Venmo and Apple Pay

While a direct transfer isn’t possible, several indirect methods can be used to move money between Venmo and Apple Pay. These methods involve using a linked bank account or a physical debit card as an intermediary.

Using a Bank Account as an Intermediary

One common method is to use a bank account as a bridge between Venmo and Apple Pay. Here’s how it works:

- Transfer Funds from Venmo to Your Bank Account: Initiate a transfer from your Venmo account to your linked bank account. This process typically takes one to three business days for standard transfers or a few minutes for instant transfers (for a small fee).

- Add Your Bank Account to Apple Pay: Add your bank account to your Apple Pay wallet. This involves verifying your account details through Apple Pay’s authentication process.

- Transfer Funds from Your Bank Account to Apple Pay Cash (If Applicable): If your bank supports it, you can transfer funds from your bank account to your Apple Pay Cash card, which is a virtual debit card stored in your Apple Wallet.

This method allows you to effectively move money from Venmo to Apple Pay, albeit indirectly. It’s important to note that the transfer times and fees may vary depending on your bank and the type of transfer you choose.

Using a Debit Card as an Intermediary

Another method involves using a debit card linked to both Venmo and Apple Pay:

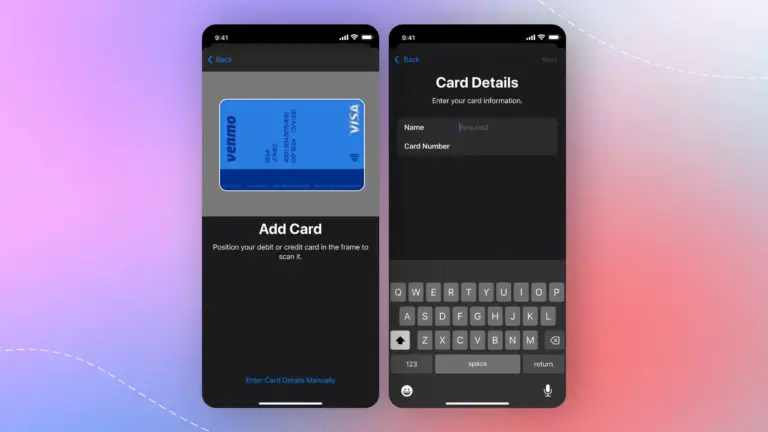

- Link Your Debit Card to Venmo: Ensure that your debit card is linked to your Venmo account.

- Transfer Funds from Venmo to Your Debit Card: Transfer funds from your Venmo account to your linked debit card. This process usually takes one to three business days for standard transfers or a few minutes for instant transfers (for a fee).

- Add the Same Debit Card to Apple Pay: Add the same debit card to your Apple Pay wallet.

- Use Your Apple Pay Balance: Once the funds are in your bank account associated with the debit card, you can use your Apple Pay to make purchases using the funds.

This method is relatively straightforward and can be faster than using a bank account, especially if you opt for instant transfers. However, it’s essential to be aware of any potential fees associated with instant transfers.

Using the Apple Cash Card

Apple Cash is a digital card within the Apple Wallet that allows users to send, receive, and spend money. While you can’t directly transfer from Venmo to Apple Cash, you can use a bank account as an intermediary:

- Transfer Funds from Venmo to Your Bank Account: As before, transfer funds from your Venmo account to your linked bank account.

- Add Funds to Your Apple Cash Card: Use the funds in your bank account to add money to your Apple Cash card within the Apple Wallet.

- Use Your Apple Cash Balance: You can then use your Apple Cash balance to make purchases or send money to others via Apple Pay.

This method is useful if you prefer to keep a balance in your Apple Cash card for various transactions.

Considerations and Potential Challenges

While these alternative methods provide ways to transfer funds between Venmo and Apple Pay, it’s important to be aware of potential challenges and considerations:

- Transfer Times: Standard transfers from Venmo to a bank account can take one to three business days. If you need the funds urgently, you may need to pay a fee for instant transfers.

- Fees: Venmo charges a fee for instant transfers. Banks may also charge fees for certain types of transfers.

- Verification: Adding a bank account or debit card to Apple Pay may require verification, which can take some time.

- Security: Always ensure that you are using secure networks and following best practices for online security when transferring funds.

The Future of Mobile Payment Integration

The mobile payment landscape is constantly evolving, and it’s possible that direct integration between Venmo and Apple Pay could become a reality in the future. Consumer demand, technological advancements, and strategic partnerships could drive these changes. As mobile payments become even more ubiquitous, seamless integration between different platforms will become increasingly important.

In the meantime, users can rely on the alternative methods described above to transfer funds between Venmo and Apple Pay. While these methods may not be as convenient as a direct transfer, they provide a viable solution for managing funds across different platforms.

Conclusion

To summarize, while you cannot directly send Venmo to Apple Pay, there are several workarounds available. By utilizing a bank account or debit card as an intermediary, you can effectively transfer funds between these two popular mobile payment platforms. Understanding the limitations and potential challenges is crucial to ensure a smooth and secure transfer process. As the mobile payment landscape continues to evolve, it’s important to stay informed about the latest developments and potential integration opportunities. Hopefully, in the future, transferring between Venmo and Apple Pay will become a more streamlined process. For now, the methods discussed provide practical solutions for managing your funds across both platforms, even if you can‘t directly send Venmo to Apple Pay. Remember to always prioritize security and be aware of any associated fees when transferring funds. The ability to send Venmo to Apple Pay directly would certainly be a welcome addition for many users. Until then, these alternative methods will suffice. The need to send Venmo to Apple Pay is a common desire, highlighting the importance of interoperability in the digital payment space. While a direct Venmo to Apple Pay transfer is not possible, understanding the existing options is key to managing your finances effectively. Many users look for ways to send Venmo to Apple Pay, indicating a strong demand for such a feature. It remains to be seen if Venmo will ever allow users to directly send Venmo to Apple Pay.

[See also: Using Mobile Payment Apps Safely]

[See also: Comparing Venmo and Zelle]

[See also: Apple Pay Security Features]