Michigan Suppressor Tax Stamp: Understanding the Regulations and Process

The world of firearm ownership can be complex, especially when dealing with accessories like suppressors. In Michigan, owning a suppressor involves navigating federal regulations, specifically obtaining a National Firearms Act (NFA) tax stamp. This article aims to provide a comprehensive overview of the Michigan suppressor tax stamp process, requirements, and related considerations.

What is a Suppressor Tax Stamp?

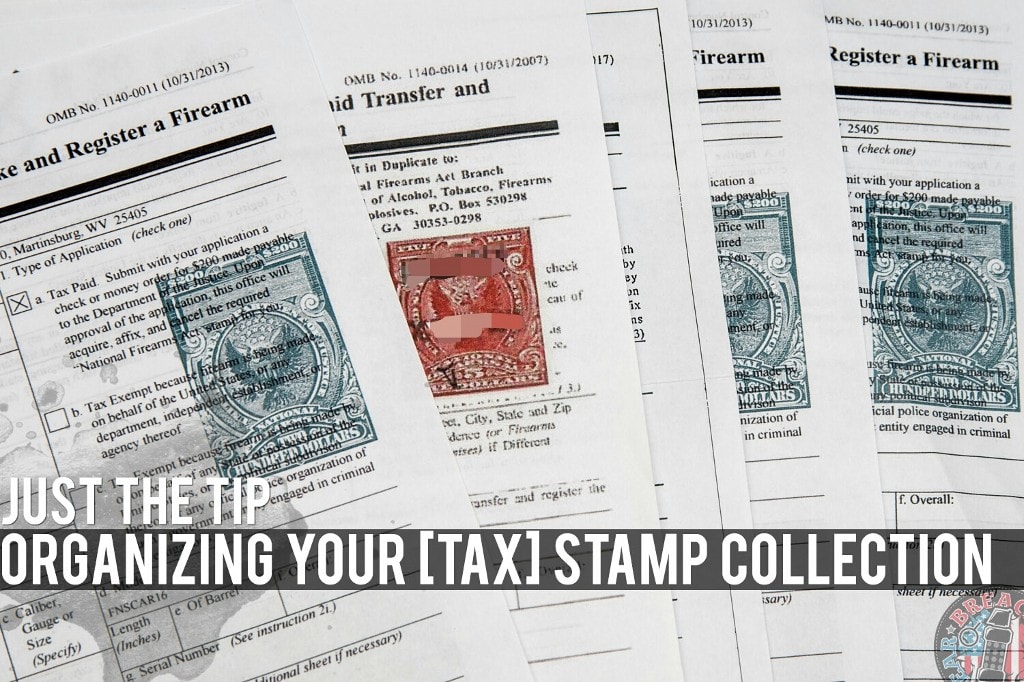

A suppressor, also known as a silencer, is a device that reduces the sound of a firearm. In the United States, suppressors are regulated under the National Firearms Act (NFA) of 1934. This federal law imposes strict regulations on the manufacture, transfer, and possession of certain firearms and devices, including suppressors. To legally own a suppressor, individuals must obtain an NFA tax stamp from the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF).

The tax stamp is essentially a permission slip from the federal government, allowing you to possess a controlled item. It requires a thorough background check, registration of the suppressor, and payment of a $200 transfer tax.

Federal Requirements for Suppressor Ownership

Before diving into the specifics of Michigan, it’s crucial to understand the federal requirements for owning a suppressor. The NFA mandates that individuals must:

- Be at least 21 years of age.

- Be a resident of the state where they intend to possess the suppressor.

- Be legally eligible to own a firearm (i.e., not prohibited due to felony convictions, domestic violence restraining orders, etc.).

- Pass a thorough background check conducted by the ATF.

- Submit an application (Form 4) to the ATF for the transfer of the suppressor.

- Pay a $200 transfer tax for each suppressor.

The application process can take several months, as the ATF processes a high volume of applications and conducts extensive background checks.

Michigan State Laws on Suppressors

Michigan generally follows federal law regarding suppressors. While federal law dictates the ownership process, Michigan law addresses the use and possession of suppressors within the state. Michigan permits the ownership of suppressors as long as the individual adheres to federal NFA regulations. There are no specific state-level permits or registration requirements beyond the federal tax stamp.

However, it’s crucial to be aware of Michigan’s laws regarding the use of suppressors while hunting or discharging firearms in certain areas. These laws may vary depending on the specific location and activity. Consult with the Michigan Department of Natural Resources (DNR) or local law enforcement for clarification on these regulations.

The Michigan Suppressor Tax Stamp Process: A Step-by-Step Guide

Obtaining a Michigan suppressor tax stamp involves a multi-step process that requires patience and attention to detail. Here’s a breakdown of the key steps:

Step 1: Research and Selection

Begin by researching different suppressor models to determine which one best suits your needs. Consider factors such as caliber compatibility, sound reduction level, size, weight, and mounting options. Consult with reputable firearms dealers or experienced suppressor owners for recommendations.

Step 2: Find a Licensed Dealer

Find a licensed firearms dealer in Michigan who is authorized to sell NFA items, including suppressors. Not all gun shops are licensed to handle NFA transfers, so it’s essential to verify their credentials. The dealer will guide you through the paperwork and facilitate the transfer process.

Step 3: Complete the ATF Form 4

The ATF Form 4 is the application form used to request the transfer of a suppressor. This form requires detailed information about the applicant, the suppressor, and the seller (the licensed dealer). You’ll need to provide your name, address, date of birth, social security number, and other personal information. You’ll also need to provide the suppressor’s make, model, serial number, and caliber. The dealer will assist you in completing the form accurately.

Step 4: Fingerprints and Photographs

As part of the Form 4 application, you’ll need to submit fingerprint cards and passport-style photographs. The ATF requires two sets of fingerprint cards, which must be completed by a qualified law enforcement agency or a private fingerprinting service. The photographs must be recent and meet specific size and format requirements.

Step 5: Notify Chief Law Enforcement Officer (CLEO)

Prior to 2016, the CLEO notification was a mandatory requirement where the applicant needed to obtain a signature from their local Chief Law Enforcement Officer. While the signature requirement was removed, the applicant is still required to send a copy of the Form 4 to their local CLEO. This serves as notification to local law enforcement that you are applying to own a suppressor.

Step 6: Submit the Application and Pay the Tax

Once the Form 4 is complete, along with the fingerprints and photographs, you’ll submit the application to the ATF. You must also include a check or money order for $200 to cover the transfer tax. The dealer will typically handle the submission process on your behalf.

Step 7: Wait for Approval

The waiting period for ATF approval can be lengthy, often ranging from several months to over a year. The ATF processes applications in the order they are received and conducts thorough background checks on each applicant. You can check the status of your application online or by contacting the ATF directly.

Step 8: Receive the Tax Stamp and Take Possession

Once the ATF approves your application, they will mail you the tax stamp. This stamp is your proof of legal ownership and must be kept with the suppressor at all times. You can then take possession of the suppressor from the licensed dealer.

Trusts and Corporations: An Alternative Ownership Method

Many individuals choose to own suppressors through a trust or corporation. This method offers several advantages, including:

- Estate planning: A trust allows you to designate beneficiaries who can inherit the suppressor without going through the NFA transfer process.

- Shared ownership: A trust or corporation allows multiple individuals to legally possess the suppressor.

- Privacy: A trust or corporation can provide a layer of privacy, as the suppressor is registered to the entity rather than an individual.

If you’re considering this option, consult with an attorney specializing in NFA trusts or corporations.

Legal Considerations and Responsibilities

Owning a suppressor comes with significant legal responsibilities. It’s crucial to understand and comply with all federal and state laws regarding suppressor ownership, possession, and use. Failure to do so can result in severe penalties, including fines, imprisonment, and loss of firearm rights.

Here are some key legal considerations:

- Storage: Suppressors must be stored securely to prevent unauthorized access.

- Transportation: When transporting a suppressor, it must be unloaded and stored in a locked container.

- Use: Suppressors can only be used in accordance with state and local laws.

- Transfer: Any transfer of a suppressor must be done through a licensed dealer and with ATF approval.

The Future of Suppressor Laws

The legal landscape surrounding suppressors is constantly evolving. There have been ongoing efforts to deregulate suppressors at the federal level, such as the Hearing Protection Act, which aimed to remove suppressors from the NFA and treat them like ordinary firearms. While these efforts have not yet been successful, they highlight the ongoing debate over suppressor regulation.

Stay informed about any proposed changes to federal and state laws regarding suppressors. Consult with legal experts and advocacy groups to stay up-to-date on the latest developments.

Conclusion

Obtaining a Michigan suppressor tax stamp is a complex process that requires careful attention to detail and compliance with federal and state laws. By understanding the requirements, following the steps outlined in this article, and seeking professional guidance when needed, you can legally own and enjoy the benefits of a suppressor in Michigan. Remember to always prioritize safety, responsibility, and adherence to the law.

The process of obtaining a suppressor tax stamp in Michigan, while lengthy, is a necessary step for legal ownership. Understanding the federal regulations and Michigan-specific laws is crucial for responsible firearm ownership. Whether you are a seasoned shooter or new to the world of firearms, navigating the NFA process requires diligence and a commitment to upholding the law. Remember to consult with qualified professionals, such as firearms dealers and legal experts, to ensure compliance and a smooth application process. The Michigan suppressor tax stamp allows individuals to exercise their Second Amendment rights while adhering to the legal framework established for these devices. The key is to be informed, patient, and proactive in navigating the regulations.

[See also: Michigan Gun Laws Overview]

[See also: NFA Trust Benefits]

[See also: Suppressor Cleaning and Maintenance]